Getting Preapproved for a Mortgage Hurt Credit? When getting preapproved for a mortgage, the lender performs a credit check that shows up as a hard inquiry on your credit report. While this inquiry can cause a slight dip in your credit score, the impact is temporary. Making consistent, on-time payments on your mortgage over time can improve your credit history and strengthen your credit score.

Does Getting a Mortgage Hurt Your Credit?

Getting a mortgage can hurt your credit score slightly at first. This is because the mortgage lender will do a hard credit check, which can cause a temporary dip in your score. However, if you manage your mortgage well by making timely payments, it can have a positive long-term impact on your credit history and future credit opportunities.

How Mortgage Pre-Approval Affects Your Credit Score

Mortgage pre-approval involves a credit check, which can appear on your credit report. This check is a hard credit inquiry and can hurt your credit score slightly. However, getting pre-approved for a mortgage gives you a clear idea of what you can afford when buying a home. The short-term dip in your score is typically minor compared to the benefits of getting a mortgage.

Mortgage Pre-Approval and Its Impact on Your Credit

When you apply for mortgage pre-approval, the lender will pull your credit report to check your credit history. This is a hard credit inquiry, which can affect your credit score. However, the impact is usually small and temporary. Over time, the mortgage rate and loan amount you secure can improve your credit, especially if you continue to make timely payments.

Does Mortgage Pre-Approval Impact Your Credit Score?

Yes, mortgage preapproval hurt your credit score. When a lender pulls your credit, it results in a hard credit inquiry, which can affect your credit. This type of inquiry stays on your credit report for a short period. While it can cause a slight dip in your score, it’s a small price to pay for understanding your mortgage options.

How Mortgage Preapproval Can Affect Your Credit

A mortgage preapproval can hurt your credit because it triggers a hard inquiry on your credit report, which may slightly lower your credit score. This process also factors in the type of credit and the loan amount you qualify for, influencing the impact on your credit. However, this effect is typically minor and temporary.

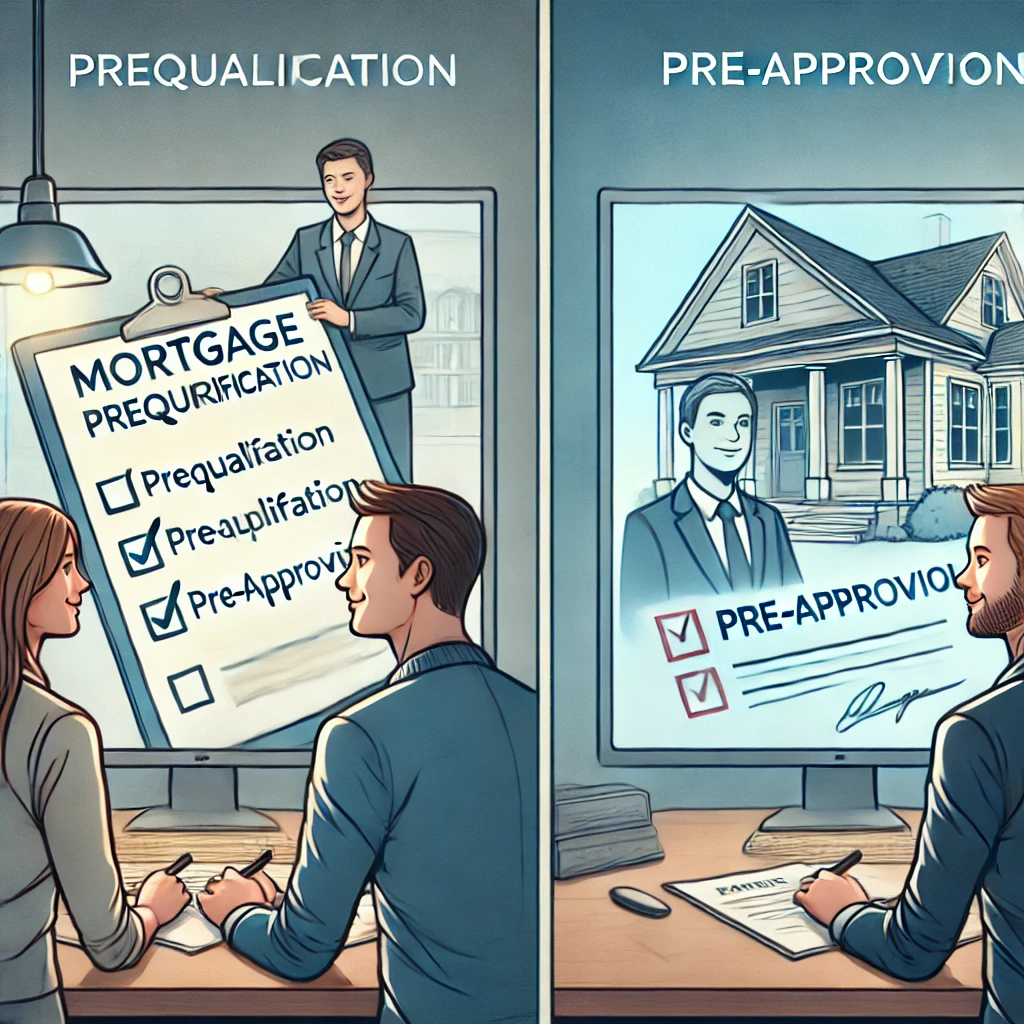

Mortgage Prequalification vs Pre-Approval: Key Differences

Mortgage prequalification and pre-approval are often confused, but they differ significantly. Prequalification involves a soft credit check and basic financial details to estimate how much you might qualify for, without affecting your credit score. Pre-approval, on the other hand, includes a hard credit pull by lenders, giving a more accurate loan amount but can slightly lower your credit score. Both processes help when you apply for credit.

Does Mortgage Prequalification Affect Your Credit Score?

Prequalification does not hurt your credit score because it uses a soft inquiry. This type of credit check is a simple review of your credit without impacting your score. When lenders perform a soft credit check, they access information from the three major credit bureaus to estimate your loan potential. Checking your own credit also counts as a soft inquiry and does not lower your credit score.

How Mortgage Pre-Approval Hurts Your Credit

Mortgage pre-approval can lower your credit score slightly because it requires a hard credit pull. This credit inquiry shows lenders that you are applying for credit, which may temporarily impact your creditworthiness. However, the impact is usually minimal if your credit is strong. While preapproval may hurt your credit score a little, it is essential for securing a loan and gives lenders a clear view of your financial readiness.

How to Improve Your Credit Score Before Getting PreApproved for a Mortgage Hurt Credit

Before starting your mortgage application, focus on improving your credit score by reducing your credit utilization and paying bills on time. Pull your credit report from the three major credit bureaus to check for errors. Fixing mistakes can increase your score by a few points. These steps ensure you are in the best financial position when getting a mortgage pre-approval, minimizing the impact on your credit score.

How to Check Your Credit Before Getting PreApproved For a mortgage Hurt Credit

Checking your credit before applying for a mortgage is crucial. You can request your credit report from the three major credit bureaus without any impact on your credit score. A soft inquiry on your credit doesn’t affect your score and allows you to review your financial standing. Understanding your credit details helps you prepare for the mortgage application and ensures accurate information before pre-approval.

How Credit Inquiries Impact Your Credit Score During the Mortgage Process

When applying for a mortgage, an inquiry can affect your credit score slightly. A hard inquiry, like a mortgage preapproval, can lower your score by a few points. However, a soft inquiry on your credit won’t affect your score. Multiple hard inquiries during a short time frame for a mortgage application may have less impact, as they are treated as a single inquiry by the three major credit bureaus.

Tips Getting Approved for a Mortgage Without Hurt Credit

To get approved for a mortgage without hurting your credit, start by checking your credit report for errors and improving your credit history. Avoid applying for new credit, such as a loan or credit card, before applying for mortgage preapproval. A single hard credit inquiry from getting a mortgage preapproval with several lenders can temporarily lower your credit score, but careful planning minimizes its effect.

How to Get Approved for a Mortgage Without Hurting Your Credit

When you apply for mortgage preapproval, ensure you limit multiple hard credit inquiries by working with one lender at a time. Checking your credit history through soft inquiries before applying doesn’t hurt your score. Avoid opening new credit accounts, like credit cards, which credit card companies often review with a hard credit pull. Careful steps help prevent unnecessary dips in your credit score during the process.

Does Applying for a Mortgage Loan Affect Your Credit Score?

Applying for a mortgage loan requires a hard credit pull, which can temporarily lower your credit score. This review of your credit by lenders ensures they understand your financial standing. However, a dip in your credit score is usually small and short-lived. Applying for mortgage preapproval with several lenders within a short period has minimal effect on your credit score, as inquiries are grouped together by credit bureaus.

How to Minimize Damage to Your Credit Score When Buying a Home

To minimize damage to your credit score when buying a home, avoid applying for new credit, such as credit cards or loans, during the process. Lender checks your credit to assess your ability to pay your mortgage, and multiple inquiries can cause your score to dip slightly. Focus on maintaining a credit score of 620 or higher by reviewing your credit history and paying bills on time.

Does Pre-Approval for a Mortgage Loan Affect Your Credit Score?

Yes, preapproval impacts your credit score because it requires a lender to run a hard credit inquiry. This may cause a small drop in your credit score, but the effect is temporary. A preapproval for a credit product like a mortgage shows lenders that you have the means to pay your mortgage. Hard inquiries stay on your credit report for two years, but the damage to your score is minimal.

How to Limit Damage to Your Credit Score During the Mortgage Process

To limit damage to your credit score, shop for a mortgage within a short time frame. When lenders run a hard credit inquiry, it can cause your score to dip slightly, but multiple inquiries for the same purpose are grouped together. A credit score of 620 or higher improves your chances of approval. Avoid applying for credit cards or loans, and focus on getting your credit score in good shape.

FAQS:

Does Getting Preapproved for a Mortgage Loan Affect Your Credit Score?

Yes, getting preapproved for a mortgage loan can hurt your credit score. The process typically involves a hard inquiry, which may cause a small dip in your score. However, the impact is usually minimal and temporary.

Does a Mortgage Preapproval Hurt Your Credit Score?

A mortgage preapproval may slightly hurt your credit score due to the hard inquiry performed by the lender. However, this is a normal part of the loan process and won’t significantly lower your score if your credit is strong.

Do Soft Credit Inquiries Affect Credit Scores?

Soft credit inquiries, such as when you check your own credit, won’t affect your credit score. These inquiries are not visible to lenders and do not influence your creditworthiness.

What Credit Score Do You Need to Get Preapproved for a Mortgage Loan?

The credit score you need to get preapproved for a mortgage loan varies by lender, but a score of 620 or higher is commonly required. Higher scores improve your chances of approval and better loan terms.